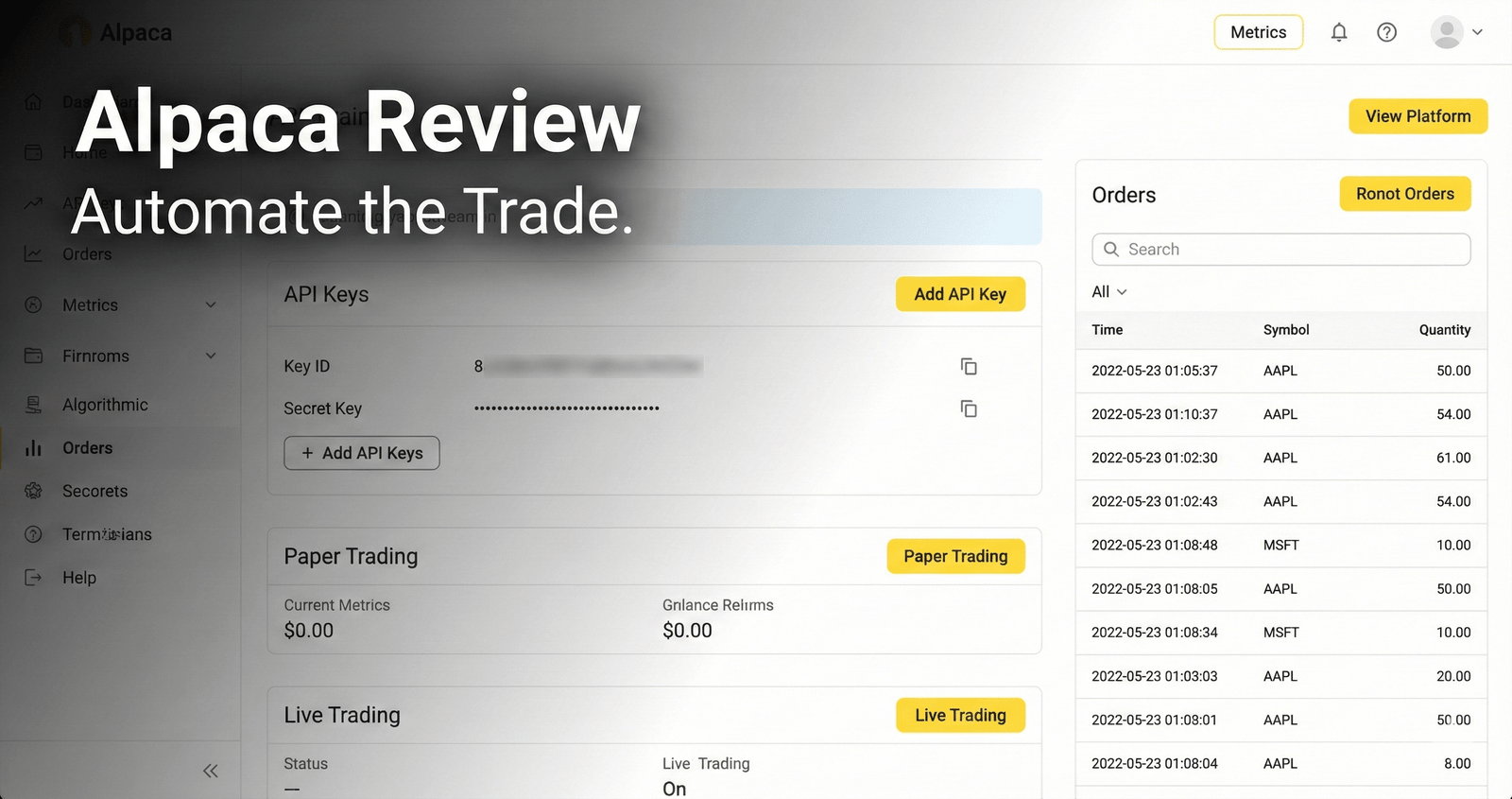

Alpaca is a developer-first broker built around an API — meaning it’s less “click buttons all day” and more “build a rules engine that clicks buttons for you.” For Yield Raiders, it can be a serious upgrade: paper test your process, automate entries/exits, and run your dividend capture plan with consistency instead of vibes.

Quick answer: Alpaca is an API-first brokerage platform that lets you trade programmatically. It’s best for traders who want to automate a strategy (or build tooling around a strategy) instead of doing every step manually.

Best for Yield Raiders: automating repeatable dividend capture rules (entries, exits, position sizing, and guardrails) and testing them in paper trading before going live.

← Back to the Tools Directory Hub | Visit site

Quick Summary

| Category | Detail |

|---|---|

| Best For | API-based trading, automation, paper testing, and rule-based execution |

| Not For | People who want a purely point-and-click broker (or who never want to touch code or automation tools) |

| Dividend Capture Fit | ⭐⭐⭐⭐☆ (4.1/5) |

What Is Alpaca?

Alpaca is a broker built for programmatic trading. Instead of living inside a traditional “broker UI,” you can connect to Alpaca via an API and place orders, manage positions, and pull market data from your own workflows.

Think of it like this: a regular broker gives you a steering wheel. Alpaca hands you the engine room controls.

What It’s Good At

- Automation-first execution: build scripts, bots, or apps that execute your rules consistently.

- Paper trading: test your system in a sandbox before you let it touch real money.

- Market data workflows: pull quotes/data into your own dashboards, logs, or alert systems.

- Stock/ETF trading by API: built for systematic strategies that run repeatedly.

- Options and crypto support: useful if your broader strategy toolbox includes these instruments (as your skill level grows).

How Yield Raiders Use It

Dividend capture is a “do it the same way every time” game. Alpaca is at its best when you treat your dividend capture process like a checklist that becomes code.

- Rules-based entries: only enter when your filters say “yes” (liquidity, volatility limits, trend filter, etc.).

- Mechanical exits: time-based exits, recovery exits, stop rules, and “no-questions-asked” guardrails.

- Position sizing discipline: your sizing rules execute the same way whether you’re confident or cranky.

- Automation with audit trails: every decision can be logged so you can review what worked and what didn’t.

“Alpaca isn’t just a broker. It’s the broker you use when you want your strategy to run like a machine.”

Watch-outs

- You need a “brain”: Alpaca executes rules — you still need to design the rules (or use a platform that helps you design them).

- Learning curve: if you’re not comfortable with APIs yet, expect a ramp-up period.

- Not a dividend calendar: you’ll still want a dedicated dividend dates tool for ex-div timing and planning.

- Automation can magnify mistakes: bad rules, bad inputs, or missing safeguards can scale problems fast.

Pricing & Access Info

- Pricing: Check site for up-to-date pricing.

- Login Required? Yes

- Best Setup: Pair Alpaca with a rules layer (your code, an automation tool, or a backtesting workflow) so you’re not “winging it” live.

Verdict: If you want to automate dividend capture (or build toward that), Alpaca is a strong execution backbone — especially when you’re serious about repeatability and testing.

Pros & Cons

Pros

- Excellent foundation for automated trading workflows

- Paper trading helps you test before risking capital

- Great for rules-based execution and logging

- Strong “build your own system” flexibility

Cons

- Not ideal if you want a purely point-and-click broker

- You must design safeguards (automation can scale mistakes)

- Not a dividend calendar or capture-planning tool

- Setup time is real (but it pays off if you stick with it)

Our Verdict

“Alpaca is the ‘automation broker.’ For Yield Raiders, it’s best when you want dividend capture to run on rules, testing, and discipline — not mood and manual clicking.”

← Back to the Tools Directory Hub | Visit site

0 Comments